Pay stubs are essential documents that provide detailed information about earnings, deductions, and taxes withheld. Whether you’re a small business owner or a freelancer, choosing the right pay stub maker is crucial. With numerous options available, it’s vital to understand the differences between free pay stub makers and paid solutions.

In this article, we’ll explore the advantages and disadvantages of both, helping you make an informed decision.

Understanding Pay Stubs

Before diving into the comparison, let’s clarify what a pay stub is. A pay stub is a document provided to employees by their employers that outlines their earnings for a specific pay period.

It typically includes:

- Gross Earnings: The total amount earned before deductions.

- Deductions: Taxes and other withholdings from gross earnings.

- Net Pay: The final amount received after deductions.

- Year-to-Date (YTD) Earnings: Cumulative totals for the calendar year.

Pay stubs serve as a record for employees to understand their compensation and are often required for loan applications or tax purposes.

Free Pay Stub Makers: Pros and Cons

Advantages

- Cost-Effective: As the name suggests, free pay stub makers don’t require any payment, making them an excellent choice for small businesses or freelancers operating on tight budgets.

- Ease of Use: Many free tools are user-friendly and designed to help users create pay stubs quickly without extensive training.

- Accessibility: Free online pay stub generators are readily available, allowing users to create pay stubs from anywhere with internet access.

- Basic Features: Most free pay stub makers offer essential features, such as customizable templates and the ability to input earnings and deductions easily.

Disadvantages

- Limited Functionality: Free tools often lack advanced features, such as automated tax calculations, multiple employee management, or integration with accounting software.

- Less Customization: While many free options provide templates, they may not allow for extensive customization, which could be crucial for businesses needing specific branding elements.

- Potential for Errors: Free pay stub generators may not always be up to date with the latest tax regulations, leading to potential errors in calculations.

- No Customer Support: Many free services do not offer customer support, meaning you may need to troubleshoot issues on your own.

Paid Pay Stub Makers: Pros and Cons

Advantages

- Comprehensive Features: Paid options often include advanced functionalities, such as automatic tax updates, detailed reports, and integration with payroll and accounting software.

- Enhanced Customization: Paid services typically allow for more extensive customization, enabling businesses to create pay stubs that reflect their brand identity.

- Accuracy and Compliance: Paid pay stub makers usually ensure compliance with the latest tax laws and regulations, reducing the risk of errors in payroll processing.

- Customer Support: Many paid services offer customer support, providing assistance with any issues or questions that may arise during the pay stub creation process.

Disadvantages

- Cost: The most significant drawback of paid pay stub makers is the cost. Subscriptions or one-time fees can be a barrier for small businesses or freelancers.

- Learning Curve: Some paid solutions may require a learning curve, especially if they come with numerous features that could overwhelm new users.

- Commitment: Paid options often require a subscription commitment, which may not be ideal for businesses with fluctuating payroll needs.

Key Considerations When Choosing

When deciding between free and paid pay stub makers, consider the following factors:

1. Budget

Evaluate your budget and determine how much you can afford to spend on a pay stub maker. If funds are tight, a free option might be more suitable, while a paid option may be justified if your budget allows.

2. Business Needs

Consider your business size and complexity. If you have a small team and simple payroll needs, a free option may suffice. However, if you manage a larger workforce or require more advanced features, a paid solution might be necessary.

3. Customization Requirements

If branding and customization are essential for your business, look for a paid option that offers extensive features. On the other hand, if basic pay stubs are all you need, a free tool might be enough.

4. Compliance and Accuracy

Ensure that whichever option you choose complies with tax regulations. Paid services often provide more assurance in this area, as they tend to update their software regularly to reflect any changes in laws.

5. Support and Resources

Consider whether you will need support when using the pay stub maker. Paid options often provide customer support, while free services may leave you to navigate any issues independently.

Making Your Choice

Ultimately, the choice between free pay stub makers and paid options depends on your specific needs and circumstances.

Here’s a quick recap to help you decide:

- Choose Free Pay Stub Makers if:

- You’re on a tight budget.

- You have minimal payroll needs.

- You’re comfortable navigating potential limitations.

- Choose Paid Pay Stub Makers if:

- You require advanced features and integrations.

- You want to ensure compliance and accuracy.

- You need customer support for assistance.

Conclusion

Both paid and free pay stub makers have their pros and cons. Free options can be a great starting point for small businesses and freelancers, offering essential features at no cost. However, paid solutions provide a more comprehensive and reliable approach to payroll management, particularly for those with complex needs.

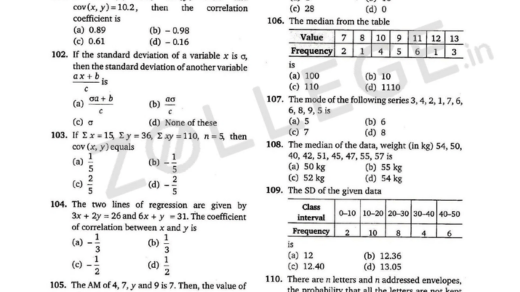

Evaluate your business requirements, budget, and the importance of features such as customization and customer support. By understanding these factors, you’ll be better equipped to choose the right pay stub maker for your needs. Whether you opt for a free or paid service, ensuring accuracy and compliance in your payroll processing is essential for maintaining trust with your employees and adhering to legal standards.