The Indian share market has developed at an incredible pace, and millions of new investors have joined in recent years. This growth has been aided greatly by digital technology, especially Trading Platforms that permit investor involvement in the seamless buying, selling, and tracking of securities. Given that there are many choices to choose from, investors are often left wondering which Share Market App or Share Market Investment App suits their needs the most. Investors can utilize comparisons of features, such as brokerage costs, tools, user experience, and integration with IPO, and margin trading facilities, to assist their decision.

What Is a Trading Platform?

A trading platform is a digital interface—either via mobile, web, or desktop—that connects investors to stock exchanges. It thus acts as a medium for direct trading between the investor and the market in equities, derivatives, mutual funds, or even IPOs.

Comparing Trading Platforms

Investors should not compare trading platforms based on just a particular feature alone; they should really compare them based on a number of these aspects:

Interface & Usability

The interface must be easy to use for even a beginner. Hence new investors can place orders and monitor their holdings with no confusion.

Brokerage Structure

With Zero Brokerage Trading Apps in India, cost efficiency has become the market-determining factor for active traders. In particular, investors compare platforms with their own brokerage policies, thereby aligning costs with trading frequency.

Order Types

Different platforms support different order types: market, limit, stop-loss, or some advanced derivative strategies. The active trader might prefer an app that is flexible across more than one order type.

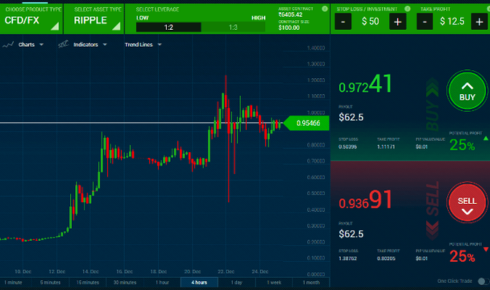

Research Tools & Analytics

Well-integrated real-time data that covers technical indicators and fundamental research is useful in soundments of decision-making.

Integration with IPO Services

If an investor is tracking Upcoming IPOs India 2025, they would want to know if the platform allows the direct application for IPOs and gives easy access to the IPO Allotment Status.

Leverage & Margin Options

Some apps allow MTF Trading (Margin Trading Facility), whereby investors can take larger positions by paying only part of the trade value.

Security & Reliability

Strong encryption and sturdy servers would secure and protect investors both from loss of funds and the compromise of personal data.

Zero Brokerage Trading Apps Vs. Traditional Platforms

Comparing the traditional brokerage platforms and Zero Brokerage Trading Apps, it is a majority of difference in today’s market. Traditional platforms may charge the investor on every trade, whereas Zero Brokerage Trading Apps eliminate or minimize it, thus attracting intraday and options traders more.

Options Trading App-Stands Out Comparison

Options trading requires specialized features; such as option chain analysis, strike price comparison, and access to implied volatility data. An Options Trading App providing these tools along with some educational resources would kick-start the beginners into derivatives.

If they are in a position to evaluate, those investing in derivatives should look for:

Support for multiple option strategies (spreads, straddles, hedges).

Real-time option greeks and payoff charts.

Integration with Margin Trading Facility Guide to understand leveraged positions.

The above points ensure that options traders can maintain risk on their chosen strategies.

Share Market Investment Apps – For The Long-Term Investor

While some platforms are designed for the working trader, others are focused on the long-term investor. A Share Market Investment App typically provides the long-term investor with access to equities, ETFs, mutual funds, and bonds along with intraday tools.

For those investing in IPOs, these apps usually integrate functions to:

View details of Upcoming IPOs India 2025.

Apply online via Linked Demat account.

Check IPO Allotment Status after shares are allotted.

This collaboration ensures that long-term investors do not require to switch between various apps for different purposes.

Understanding Margin Trading Facility

To fulfill such objectives for traders wishing to amplify their exposure, MTF Trading (Margin Trading Facility) is offered by many platforms today. Investors may take positions larger than the capital available to them by paying a fraction of the transaction value.

Upcoming IPOs and Trading Platforms

It has become an important aspect of investing within India to get IPO participation. Many investors therefore look forward to Upcoming IPOs to expand their portfolio further. Trading platforms that incorporate IPO modules have made IPO participation fast and easy in:

Direct application using the Demat account.

Allotment updates under the IPO Allotment Status.

Post-listing trading of shares within the same app.

Platforms that have joined IPO tracking in trading tools give one a complete setting for both short investment and long investment.

Comparing Platforms – Key Takeaways

When comparing trading platforms, investors should:

Ascertain whether they are in the market for an app focused on intraday and derivatives or long-term investing.

Look for features like zero brokerage, options analytics, and IPO modules.

Make sure they consider the app’s ease of use in opening a Demat Account online.

Examine integrated tools such as MTF, portfolio tracking, and research reports.

By balancing affordability with functionality, traders and investors will find a platform best catered to their objectives.

Conclusion

Trading Platforms in India have evolved to cater to diverse investor needs. The choice between Zero Brokerage Trading Apps in India designed for cost-conscious traders and Share Market Investment Apps originally meant for long-term investors is determined by one´s investment strategy.